Re-entry after a market exit – requirements, chances and risks

Client: Global pharmaceutical company

Field of application: 8-week drip therapy with positive long-term effects and orphan drug designation

Challenge

The pharmaceutical company's therapy met the special requirements of the AMNOG procedure in Germany, but had to be withdrawn from the market again due to an insufficient reimbursement amount. In addition to robust evidence, there was a lack of necessary strategic know-how in the German context. Following the subsequent achievement of a significantly higher therapy price in the USA, this success was subsequently to be extended to Germany.

A renegotiation of the rebate in Germany will be triggered, among other things, by a renewed benefit assessment by the German Federal Joint Committee (Gemeinsamer Bundesausschuss, G-BA). In order to be able to achieve this as a pharmaceutical company, "new scientific evidence" is required according to chapter 5 § 14 of the G-BA's rules of procedure. The company was thus faced with the following questions:

- Are the newly generated data sufficient for resubmission to the G-BA?

- Can a higher additional benefit be achieved with the help of the new scientific evidence compared to the first procedure?

- What are the opportunities and risks for price negotiations and ultimately the resulting reimbursement amount?

- Are there alternative ways to renegotiate an already negotiated reimbursement amount?

Solution and approach

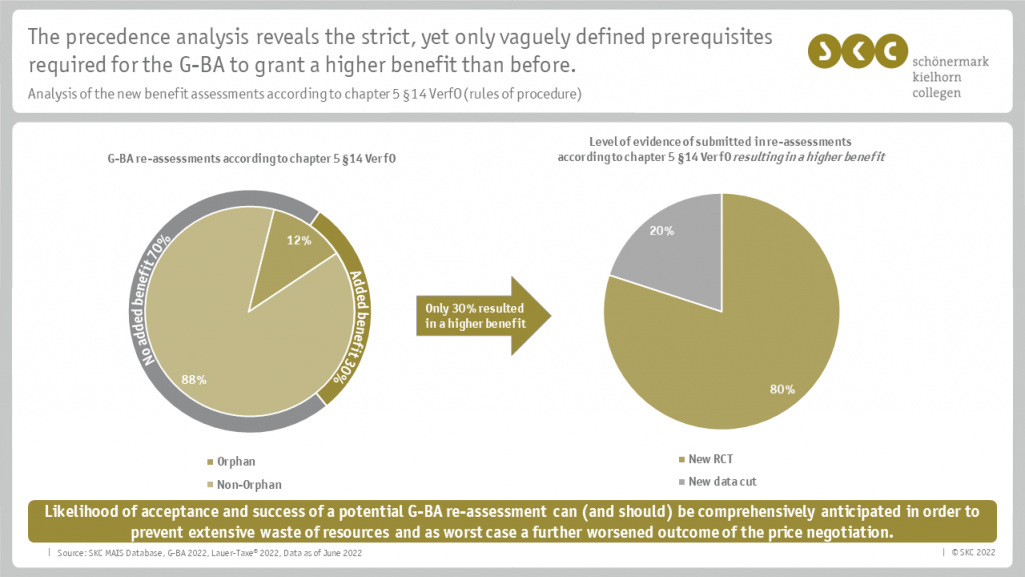

To answer the questions, SKC conducted, among other things, a precedence analysis of the reassessments according to chapter 5 § 14 rules of procedure. SKC was able to create an overview based on its own MAIS database, which contains all relevant information about all German G-BA procedures and GKV-SV price negotiations so far. Based on the results of the analysis, SKC evaluated the available evidence of the company and ultimately the chance of a higher price.

In addition, SKC looked at the opportunities of two other options:

- Imports into Germany based on individual cases

- The resumption of the old price and a repositioning in the German market

Added value

In summary, it became apparent that the process and positioning in the initial benefit assessment has considerable significance for reassessments. Full knowledge of the German HTA process is critical to overall success - a rushed market entry can substantially jeopardize the availability of the drug to patients. The company also gained insight into its product's chances of renewed, successful price negotiations while assessing the risk of higher discounts. Further options and the associated opportunities for the company also became clear.