Outcomes of benefit reassessments of orphan drugs in Germany

after exceedance of the 50-Mio.-EUR revenue threshold

Objectives

For orphan drugs in Germany, an added benefit is granted by law within the early benefit assessment. However, this privilege no longer applies if the drug's turnovers exceed 50 million euro within 12 months, leading to a benefit reassessment based on a comparison against an appropriate comparative therapy. The objective of the current study is to evaluate the development of an orphan drug's added benefit as well as the negotiated price rebate after reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold.

Methods

Outcomes of all German early benefit assessments of orphan drugs for which reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold had started by October 2021 were analyzed. The number and size of subpopulations and the respective granted added benefit as well as the resulting negotiated price rebates after the first assessment and after reassessment were determined.

Characterization of orphan drugs exceeding the 50-Mio.-EUR revenue threshold

For orphan drugs in Germany, an added benefit is granted by law within the early benefit assessment. However, this privilege no longer applies if the drug's turnovers exceed 50 million euro within 12 months, leading to a benefit reassessment based on a comparison against an appropriate comparative therapy.

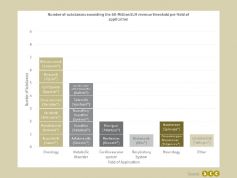

Between March 2011 and October 2021, the 50-Mio-EUR revenue threshold was exceeded by

- 7 out of 40 oncologic orphan drugs (17.5%),

- 5 out of 26 orphans (19.2%) in the field of metabolic disorder,

- 2 out of 2 orphans (100%) in the field of cardiovascular diseases,

- 1 out of 2 orphans (50%) in the field of disorder of the respiratory system,

- 2 out of 7 orphans (28.6%) in the field of disorder of neurology,

- 1 out of 2 orphans (50%) in the field of other disorders.

None of the orphan drugs of other indications (eye diseases, infectious diseases, disorders of the blood and blood-forming organs, disorders of the muscle-skeletal-system, disorders of the gastrointestinal tract) exceeded the 50-Mio.-EUR threshold.

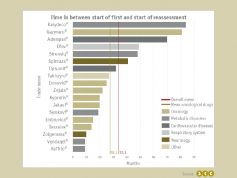

The average time between the start of the first assessment of an orphan drug and its reassessment after exceedance of the 50-Mio.-EUR revenue threshold, is 33.1 months (sd= 23.5 months). With a mean time of just 28.1 months (sd = 21.9 months) in the field of oncology, the mean time is 14.9% (4.91 months) shorter than the overall average. Oncological orphan drugs exceed most often and faster than average the 50-Mio.-EUR annual revenue threshold in Germany, making up to 38.9% of all orphan drug that exceeded the threshold until October 2021.

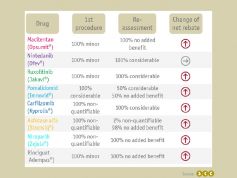

Development of population with granted added benefit after reassessment

The substances obinutuzumab (Gazyvaro®), onasemnogen-abeparvovec (Zolgensma ®), lanadelumab (Takhzyro ®) and ivacaftor/ tezacaftor/ elexacaftor (Kaftrio ®) are excluded from this analysis since the price negotiations of the reassessment are not finished yet. Ivacaftor (Kalydeco®) is excluded from this analysis, since the area of application was extended prior to exceedance of the revenue threshold.

If the estimated size of a population is indicated across multiple subpopulations with different associated added benefits in the G-BA resolution, the number was distributed in equal parts among all affected subpopulations. Likewise, if the subpopulation's size is given as a range, the range's mean was taken as expected value.

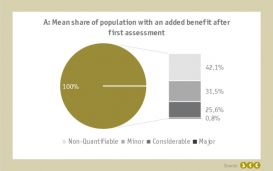

As defined by German law, all drugs which have an orphan status receive an added benefit after the early benefit assessment (left pie chart). However, this privilege no longer applies if the drug's turnovers exceed 50 million euro within 12 months, leading to a benefit reassessment based on a comparison against an appropriate comparative therapy.

Across all orphan drugs exceeding the threshold, in the first assessment on average 42.1% of the total population received a non-quantifiable, 31.5% a minor, 25.6% a considerable and 0.8% a major added benefit (right bar chart).

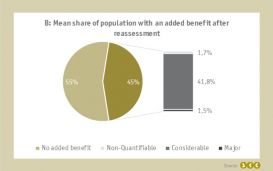

After reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold, the mean proportion of the total patient population with a granted added benefit decreased from 100% to only 45.0% (left pie chart).

Interestingly, on average 41.8% of the overall patient population were granted a considerable added benefit after reassessment whereas only for a mean of 1.7% of the overall patient population the added benefit was considered non-quantifiable (right bar chart).

The reassessment after exceedance of the threshold generally bears the risk of losing the previously granted added benefit for a large portion of the patient population (55% on average) but likewise comes with the chance to extend the share of population with a quantifiable added benefit, e.g. considerable added benefit for 41.8% on average.

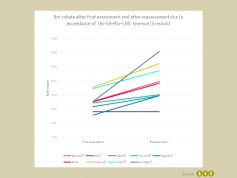

Development of net rebate after reassessment

The substances obinutuzumab (Gazyvaro®), onasemnogen-abeparvovec (Zolgensma ®), lanadelumab (Takhzyro®) and ivacaftor/ tezacaftor/ elexacaftor (Kaftrio ®) are excluded from this analysis, since the price negotiations of the reassessment are not finished yet. Further ibrutinib (Imbruvica®) and daratumumab (Darzalex®) are excluded, because new indications are included in the reassessment, which potentially influence the negotiated rebate.

For orphan drugs in Germany, an added benefit is granted by law within the early benefit assessment. However, this privilege no longer applies if the drug's turnovers exceed 50 million euro within 12 months, leading to a benefit reassessment based on a comparison against the appropriate comparative therapy. Reassessment often leads to the loss of the added benefit and high pressure on the price during negotiations with the GKV-SV.

Although in 3 out of 8 cases the granted added benefit category was higher after reassessment compared to the first benefit assessment, the net price rebate increased in 7 out of 8 cases after reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold.

The overall mean net rebate increased from 25.2% after the first benefit assessment to 38.5% after reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold, which reflects an average absolute increase of 13.3% and a relative increase of 52.8%.

Only in the case of Nintedanib (Ofev®) the net rebate remained unchanged after the benefit reassessment due to the exceedance of the 50-Mio.-EUR revenue threshold. A reduction of the net rebate after reassessment, i.e. an increase of the reimbursed price, was not observed in either of the eight cases. Thus, even if the outcome of the benefit reassessment after exceedance of the 50-Mio.-EUR revenue threshold is better than the outcome of the first benefit assessment, there is a high risk of an increase in the negotiated net price.

Therefore, pharmaceutical companies should carefully assess whether a voluntary price reduction to avoid the exceedance of the 50-Mio.-EUR annual revenue threshold may be more beneficial than taking the risk of a benefit reassessment under non-orphan conditions.

About the author

Manager Market Access

M.Sc. Human Biology

Fax: +49 511 64 68 14 18