Awakening of the hemophilia market – long-acting drugs and gene therapies offer huge potential

Long-acting drugs offer a huge advantage to hemophilia-patients, because the daily and most often intravenous treatments can be avoided. Impressive sales have been generated with recombinant antihemophilic factor drugs like Eloctate (Bioverativ Inc.: USD 186 million in the third quarter of 2017) or Kovaltry (Bayer AG: EUR 1.17 billion in 2016). But also recent innovations like Roche’s Hemlibra are extremely promising. In a first clinical study the bleeding rates of hemophilia A patients with inhibitors have been reduced by 87%. Although Roche had to face different challenges, Hemlibra was approved by the US FDA in November 2017.

What’s more, even bigger market eruptions are expected from gene therapy treatments. BioMarin’s drug BMN 270 achieved Factor VIII levels above 50%, equivalent to the level of healthy humans, in a Phase 1/2 open-label study with hemophilia A patients. SPK-9001, a drug for hemophilia B from Sparks Therapeutics Inc. and Pfizer Inc., is also groundbreaking. This gene therapy drug has the potential to guarantee a permanent activity of the clotting factor IX after just a single infusion. Furthermore, Alnylam Pharmaceuticals Inc. and Sanofi SA are developing a kind of all-purpose drug (Fitusiran), that shall be used to treat hemophilia A and B patients, with or without inhibitors. Moreover, pharmaceutical companies such as Sangamo Therapeutics Inc., Shire plc or UniQure N.V hope to achieve a breakthrough in the hemophilia market with their gene therapeutic innovations.

[caption id="attachment_3561" align="alignnone" width="1215"]

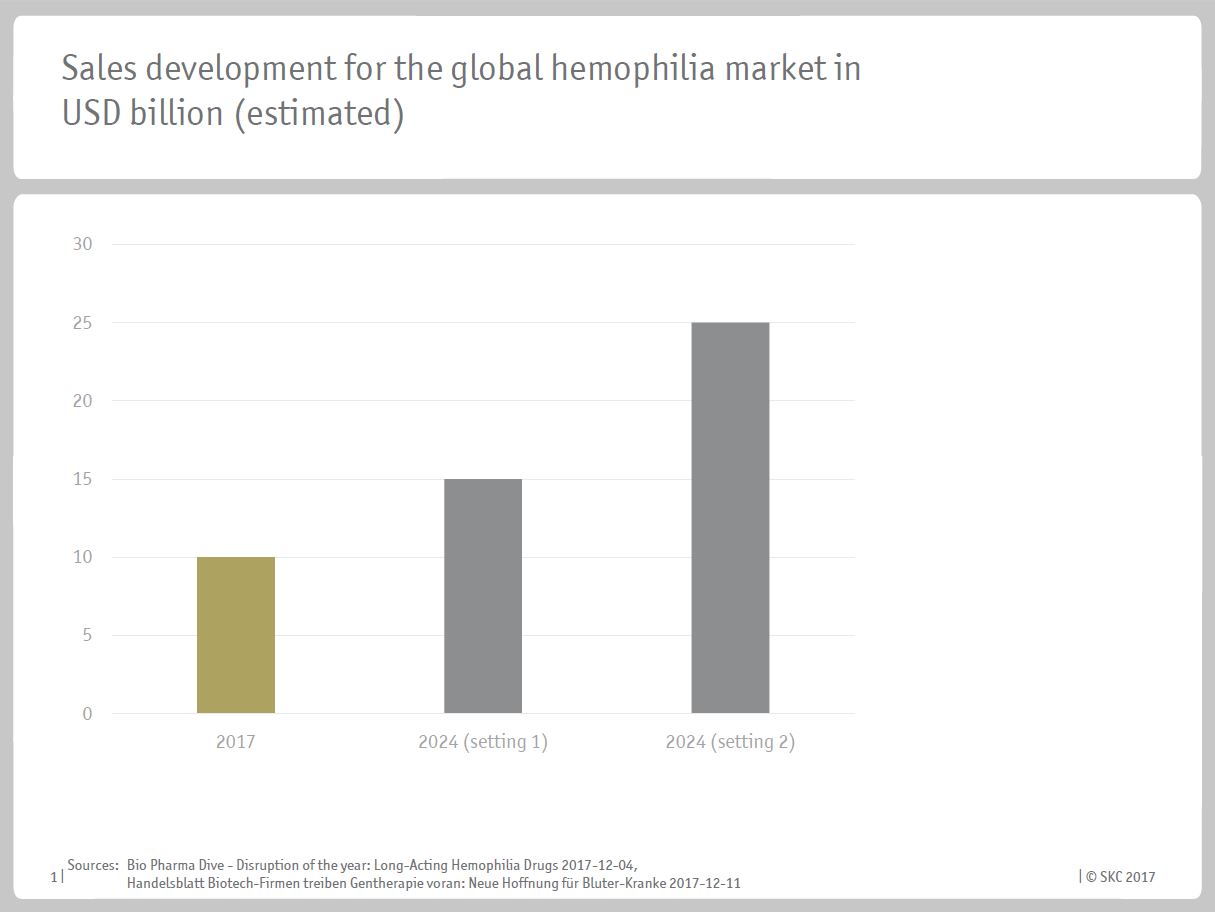

Sales development for the global hemophilia market in USD billion (estimated)[/caption]

Sales development for the global hemophilia market in USD billion (estimated)[/caption]With these new therapeutic possibilities introduced to the market, existing brands might fear for their existence. Within the next years, companies like Novo Nordisk A/S or Shire expect their sales to be skimmed off by up to 50% by innovative hemophilia drugs. Nevertheless, drugs for the treatment of bleeding disorder represent a highly profitable field of the pharmaceutical market. At present, the global revenue accounts to roughly USD 10 billion. Furthermore, market researches are forecasting a massive future potential and expect the market sales to reach a volume of USD 15 to 25 billion by the year 2024. Hence, the hemophilia market finally sets into motion, resulting in improvements for the patients.

BY Prof. Matthias P. Schönermark, M.D., Ph.D., Founder and Managing Director, SKC Beratungsgesellschaft mbH

Sources:

Bio Pharma Dive - Disruption of the year: Long-Acting Hemophilia Drugs

Roche - Media Release Hemlibra

BioMarin - BMN 270 for Hemophilia A

Spark Therapeutics and Pfizer Announce Publication in The New England Journal of Medicine

Handelsblatt - BioTechFirmen treiben Gentherapie voran: neue Hoffnung für Bluter-Kranke